- We study human behavior, ahead of the change.

- We define transformative themes, ahead of the signals.

- We target companies with a competitive edge, ahead of their peers.

- We move aggressively to capture growth, ahead of the crowd.

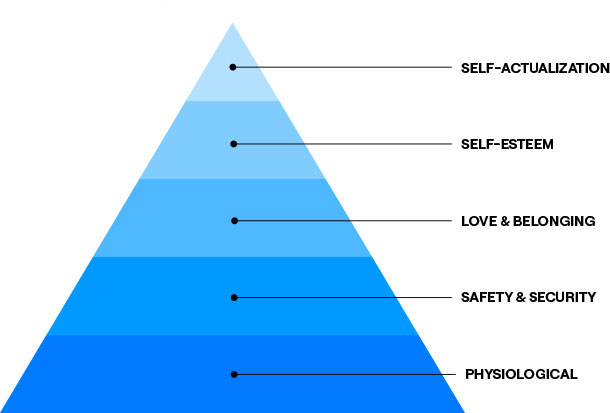

Human behavior is at the core of what we do

Pence Capital Management, LLC is a registered investment advisory firm based in Newport Beach, California.

The firm’s investment approach adheres to its founding principles, which bring together the study of human behavior and economic analysis. Our investment team comprises professionals with diverse perspectives and credentials as economists, experts in behavioral finance, psychology specialists and former military leaders.

Founded by E. Dryden Pence III, a Harvard-educated economist with thirty years of experience in the financial industry, and a retired Army Colonel specializing in Intelligence, Special Operations and Psychological Warfare, the firm aims to capitalize on the supply chain of human demand to identify investment opportunities.

A PROPRIETARY APPROACH

Our investment perspective leverages expertise in behavioral finance and our founder’s experience as a leading military intelligence officer specializing in psychological warfare. This rare combination of skills helps us to anticipate and capitalize on the human factors that shift the balance of competition across sectors and industries.

Our proprietary investment approach, Choke Point Investing™, validates the influence of human factors on security selection.

INVESTMENT PHILOSOPHY

We believe that investments grounded in real-world opportunities make more sense. Tapping into the consumer’s decision-making process at an early stage enables us to use that information to guide us on what they are going to buy and from whom they will buy it.