The last two weeks have been anything but boring. War, bombing, a ceasefire, international second guessing of battle damage assessments and the S&P 500 is back near an all-time high. The risk of a major impact on oil prices has not materialized. In fact, an objective review of the data reveals that the US has little direct exposure to a supply shortfall in the event of a major disruption to oil supplies in the Middle East. We maintain our stance that 2025 is likely a year of continued U.S. economic growth.

With the U.S. military strikes on Iranian nuclear facilities over the weekend, worries surround the possibility of another escalation in Middle East in tensions and the impact that could have on markets and the path for international relations. While the ultimate trajectory of the conflict remains unclear, we believe that the general avoidance of Iran’s oil facilities as military targets and the restrained nature of Iran’s retaliation on Monday lend optimism towards a non-expansionary conclusion to this episode.

For markets, it’s important to note that geopolitical conflicts tend to be one of the things that markets absorb best as they are typically short-lived or idiosyncratic events with limited or transitory impacts on the global economy. According to data compiled by LPL Research, the average drawdown from a geopolitical shock event post-2000 is just 3.3%, with a full

recovery in an average of just 19 market days.

We think that the muted reactions seen in markets since Israel’s initial strikes largely boil down to the realities on the ground, that the economies in question are relatively small and neither has a chokepoint on any globally necessary commodity, while all parties in the conflict have thus far shown to be acting rationally in regard to the region’s energy production – which is by far the area that would have the largest impact on the U.S. Economy and U.S. Markets.

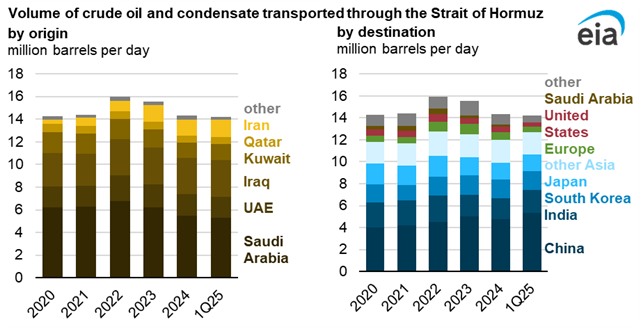

That said, the situation in Iran remains fluid and the current reality around Iranian oil production levels and the Strait of Hormuz could change with any further escalation. While oil is a globally priced commodity, the impact on supply in the United States is significantly less than many other nations due to the structure of existing oil production and flows of trade.

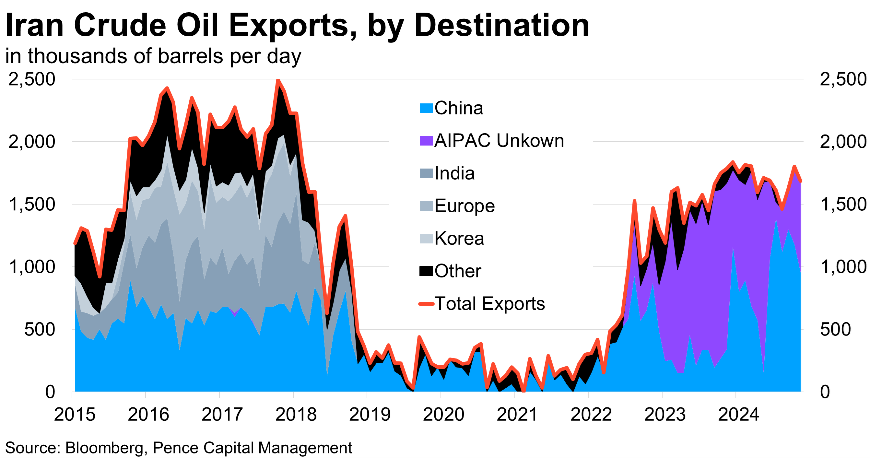

Iran is the sixth largest global oil producer and Iranian crude has been one of the largest incremental sources of supply since Russia’s invasion of Ukraine in 2022. However, the vast majority of this supply is exported to China, which accounts for 57-100% of Iranian exports according to vessel tracking estimates by Bloomberg. In the event of any strikes on Iranian oil production, there remains roughly 4.5 million barrels of spare production capacity at other members of OPEC – though the export of this surplus capacity is nearly entirely reliant on the Strait of Hormuz remaining open.

Given the damage to Iranian infrastructure and the high reliance of the Iranian government on oil revenues, we believe a closure of the Strait of Hormuz is a low probability outcome. However, in the event of a closure, the United States is uniquely insulated relative to other oil consuming countries.

In 2024, U.S. crude oil imports from countries in the Persian Gulf were at the lowest level in nearly 40 years as domestic

production and imports from Canada have increased, just 7% of crude imports and less than 2% of total daily U.S. oil consumption is transported via the Strait of Hormuz, despite 20% of global oil consumption traveling through the strait. This is in stark contrast to the more than 30% of oil consumption that China, India, and South Korea import via the waterway.

With the telegraphed nature of the Iranian response to U.S. strikes, and the subsequent comments from President Trump around de-escalation, we are optimistic that the events over the weekend are contained. We are mindful of the events in the Middle East and are watching them carefully in the event of expansion or contagion, but we believe the uniquely insular

nature of a U.S. economy that primarily sources energy domestically will prove resilient.