Bottom Line Up Front

Despite a volatile Q2 2025 marked by a sharp market sell-off due to tariff concerns, the S&P 500 staged a remarkable recovery, supported by resilient corporate earnings and a robust U.S. economy, though uncertainty around tariffs and inflation remains a key risk.

We maintain our positive outlook for markets, driven by strong fundamentals, continued robust demand around Artificial Intelligence, and a weaker dollar, but note that tariff impacts and potential inflation could pose challenges in the second half of the year.

Climbing the Wall of Worry

Markets showed impressive resilience in a quarter fraught with volatility. Despite the S&P 500’s 14% collapse in the first week of April as President Trump displayed his administration’s reciprocal tariff rates – dubbed the “Chart of Death” – markets staged a furious rally as the Trump administration dialed back its maximalist approach and talks with trading partners began. From the lows of April, the S&P 500 rallied 30%, reaching a new all-time high by the end of the quarter.

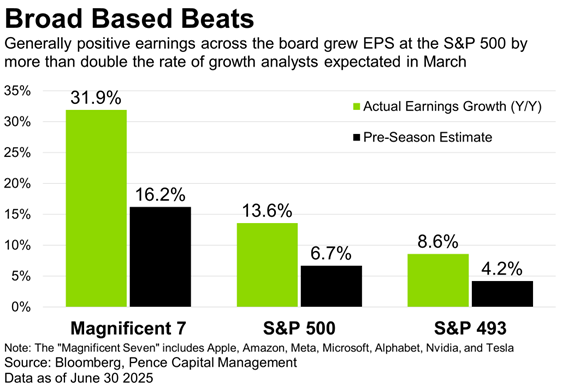

While the tariff U-turn in April is the largest driver of the sentiment change in markets, thus far, none of the most negative economic prognostications from “Liberation Day” have come to pass. First quarter earnings for the S&P 500 came in well ahead of expectations, with tariff impact guidance looking manageable and capital expenditures for Artificial Intelligence (A.I.) infrastructure remain intact. For the economy, the labor market and economic growth have held up, while inflation has been benign thus far. Some tariff pass-throughs to inflation are visible in the data, but so far they have been outweighed by meaningful deflation in cyclical categories like airfares, hotels, and energy.

As we turn the page on the first half of 2025, we maintain our positive outlook on the year. However, the final destination for U.S. tariffs remains unclear, and their hit to earnings or pass-through to consumer prices is far from certain. With the now-August 1st deadline for President Trump’s reciprocal tariff pause looming, we think clarity on the path of inflation will be more precise in coming months as businesses confront the likely reality of tariffs that are both higher and longer-lasting than they would like. There’s a very reasonable likelihood that companies have been generally hesitant to raise prices and risk customer relationships in response to trade policy that has been highly volatile and in a near-constant state of flux.

Markets

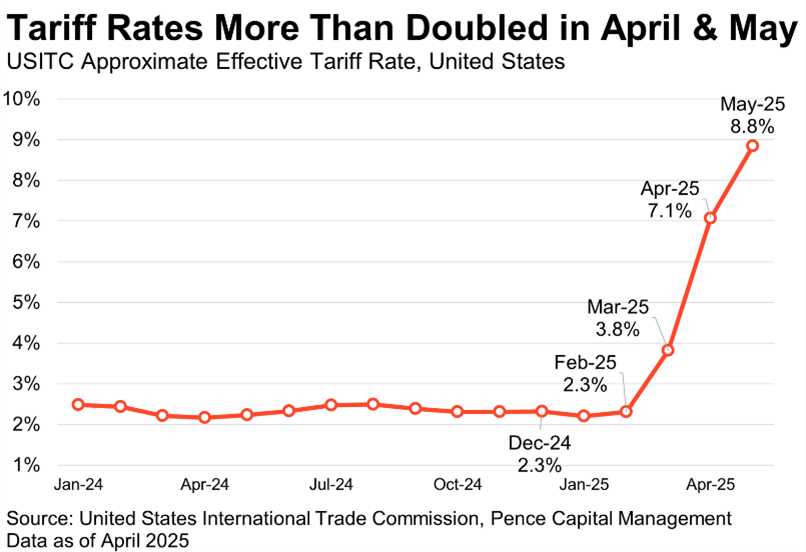

The second quarter of 2025 was anything but boring. One of the largest potential increases to U.S. tariff rates since Smoot-Hawley in 1930 led to the sharpest sell-off since the 2020 COVID lockdowns, and the subsequent backtracking on tariff threats set the stage for one of the fastest rallies in market history, including its biggest daily gain since 2008 after U.S. President Donald Trump declared an immediate 90-day tariff pause for many countries.

Given the market moves, you would be forgiven for thinking that tariffs and their impact have dissipated entirely. The reality, however, is that tariffs are very much a fact of life, though the magnitude of their increase and effect on U.S. economic growth have defied the worst-case scenarios market participants envisioned at the start of the quarter. Despite significant panic around U.S. growth in April, the U.S. economy made it through April, May, and June without a negative payrolls print, growth held up generally well, and there has been meaningful progress on trade negotiations with several significant U.S. trading partners.

In aggregate, earnings releases have shown limited signs that tariffs are weakening corporate fundamentals in a broad-based way. Some companies are being hit more than others, but in general, the tariff impacts signaled in corporate guidance appear unhelpful, but manageable. A few members of the “Magnificent Seven” are more impacted by tariffs than others, but aggregate impacts appear limited so far, and the change in trade policy has not affected corporate guidance on capital expenditures for Artificial Intelligence (A.I.) computing power. A.I was a key contributor to Microsoft’s Cloud beat last quarter, and all company comments so far have been around continuing or expanding high levels of capital spending on the data center buildout.

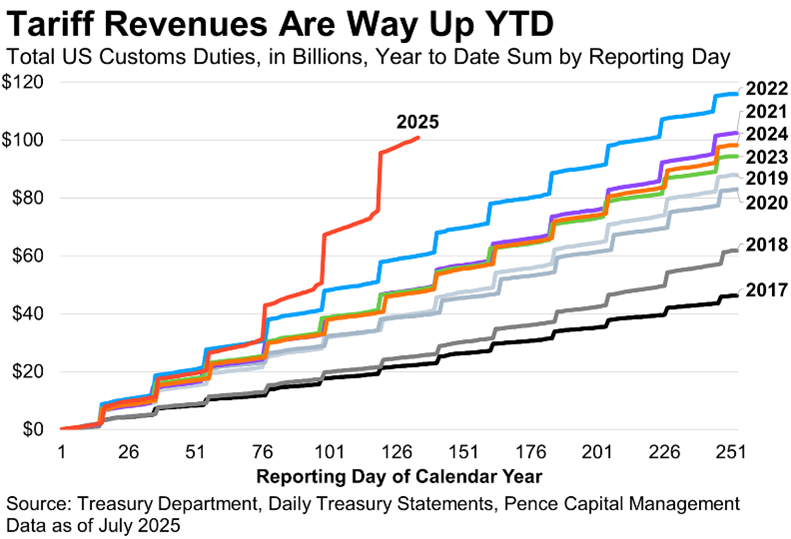

While the broad outperformance to estimates by S&P 500 companies in the first quarter was heartening, it’s important to note that tariff impacts in the first quarter were muted as the bulk of the increase in U.S. trade levies occurred after the end of the quarter. The U.S effective tariff rate increased from 3.8% to 8.8% between March and May. Overall tariff collections went from being roughly 20% higher year over year in March relative to 2024, but by June, tariff collections had increased by 110% relative to 2024. While tariffs were largely theoretical for all but a handful of companies in the first quarter, in the second quarter, they became very real. The result is likely to be a fairly sharp drop in earnings growth, with the S&P 500 expected to grow earnings by just 2.8% year over year in the second quarter. However, while the rate of growth has slowed, the S&P 500 is expected to avoid an outright decline in profits.

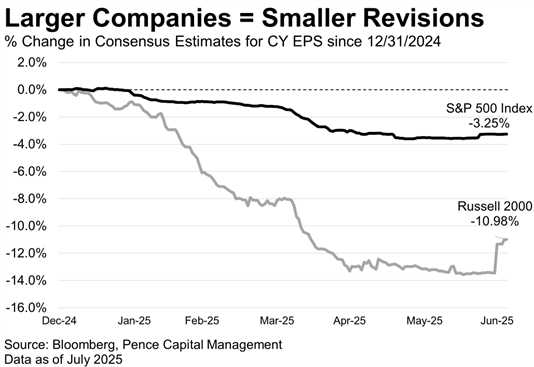

Additionally, the scale of revisions is far smaller than other U.S. market indices, reflecting a level of pricing power for larger companies that is not seen at their smaller counterparts. An April survey from the Atlanta Fed shows that small companies are having a harder time passing through prices than their bigger counterparts, which is reflected in earnings revisions for the year. While the S&P 500 has seen earnings expectations for the whole year drop by only 3.3%, earnings per share expectations for the Small Cap Russell 2000 have dropped by 11%.

The S&P 500 also has a long and storied track record of beating consensus estimates, with the first quarter of 2020 being the only time the S&P 500 missed forecasts in the last 46 quarters. And while the bar for forthcoming earnings is certainly low, markets have an added catalyst in the form of the U.S. dollar – which just wrapped up its worst start to a year in more than half a century, weakening more than 10 percent over the past six months when compared with a basket of currencies from the country’s major trading partners.

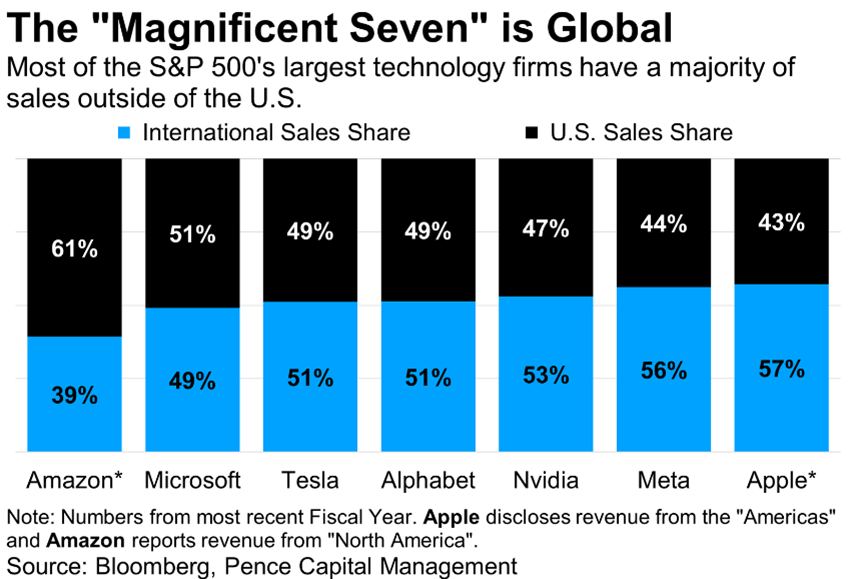

A weak dollar is not positive from the perspective of a U.S. consumer or U.S. tourist as it makes foreign goods more expensive. However, it is extremely positive for U.S. exporters and U.S. companies with large overseas operations as it makes their products cheaper for foreign buyers, boosting international sales. It also increases the value of overseas profits when companies repatriate profits earned in stronger foreign currencies, as those earnings convert to more dollars, which improves overall revenue and profitability.

All but two of the “Magnificent Seven” technology companies generate more than half of their revenue overseas, and moves in currency markets make the likelihood of meeting or surpassing market estimates higher. Considering that the “Magnificent Seven” represents roughly a third of the S&P 500 and that the overall index generates 41% of its aggregate revenues abroad, the currency boost to revenues and profits could prove positive as we progress through the year.

The Economy & “One Big Beautiful Bill”

While corporate fundamentals have been supportive of markets thus far, they’ve been boosted because the U.S. economy has generally held up well, considering the trade volatility and uncertainty in April and May.

For the labor market, job additions modestly accelerated in the second quarter after fairly hefty downward revisions to job gains in the first quarter. At the consumer level, sentiment has lifted from its doldrums but remains fairly downbeat. We will, however, note that negative sentiment had little to no impact on July 4th travel plans, which AAA estimates were not only robust but likely saw a record number of travelers. For the aggregate economy, Gross Domestic Product (GDP) is slated to improve notably after the January-March quarter saw Real GDP decline for the first time since 2022.

There are, however, caveats to most statistics in what continues to be a boisterous economic environment that has essentially evolved into a “Choose Your Own Adventure” economy. There is something in the data for everyone, which often boils down to an individual’s preferred prescription on political party control or the path for monetary policy. Growth is notably slowing for some, and the labor market continues to soften. For others, the Soft-But-Not-Awful data is a significant sign of resilience in a period fraught with uncertainty.

The reality, as with most things, is somewhere in the muddled middle. The 0.5% decline in economic growth in the first quarter was wildly overstated as a historic rush of imports lowered GDP by 4.6% – a record – while the likely rebound in the second quarter is similarly overstated due to a lower level of imports. Second quarter job additions picked up sizably relative to the first. Still, half of June’s job additions were at the State and Local level – in what could be a seasonal quirk for a segment of the job market that is not cyclically sensitive.

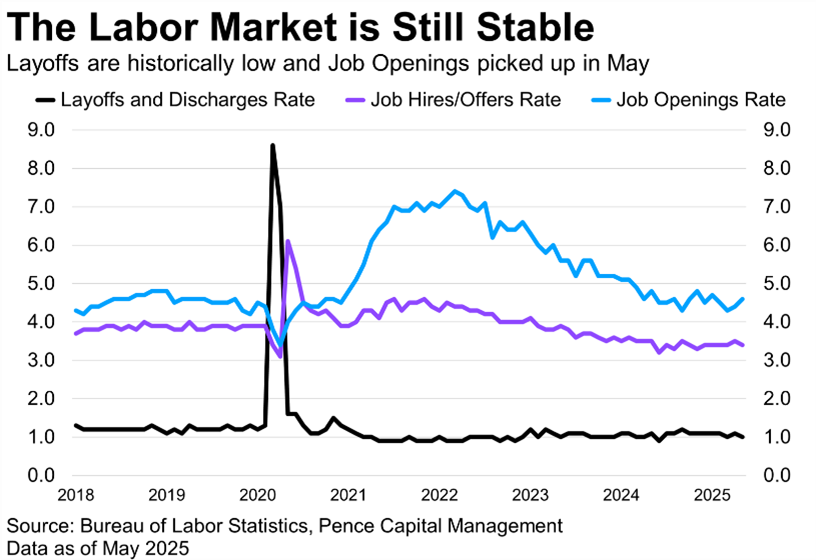

In our view, this is all emblematic of an economy in a period of transition and a business sector on “Push” – delaying actions as they await certainty on U.S. policy surrounding trade and taxes. Currently, Corporate America is in a liminal space as they await a definitive answer on tariffs – they aren’t reacting aggressively, nor are they reacting overwhelmingly proactively. Hiring rates have softened somewhat, but layoff rates are also near all-time lows. The labor market, in aggregate, has also been contending with a meaningful shift in U.S. government policies surrounding immigration, which has dropped precipitously in 2025.

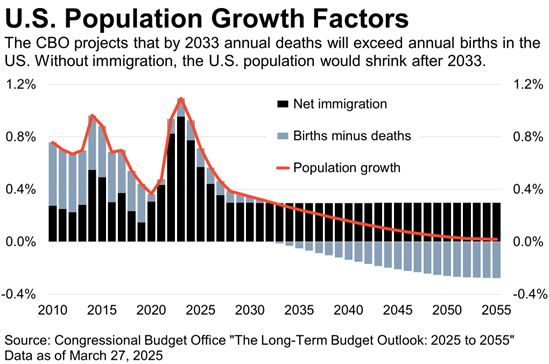

Throughout the post-pandemic expansion, high levels of immigration have been a key ingredient in raising the unemployment rate without meaningful layoffs. With a significant drop in immigration rates, downward pressure is placed on labor force growth in the U.S. economy – especially in the context of an aging native-born population with a low birth rate. So, while the pace of job gains has moderated somewhat from last year, this has not come with a rise in the unemployment rate or meaningful change in the balance between unemployed workers and the number of job openings in the economy.

And while there remains sizeable uncertainty around the ultimate destination for tariffs, the passage of the One Big Beautiful Bill Act provides certainty on the outlook for tax policy. The $3.4 trillion bill, which extends in permanence 2017’s Tax Cuts and Jobs Act and institutes a rash of new tax policies, will take time to impact the economy but removes the looming risk of a tax cliff as the individual tax provisions in the Tax Cuts and Jobs Act (TCJA) would have expired all at once at the end of 2025. This would have resulted in substantial pressure on consumer spending as the increase in individual taxes would have hit alongside the sizeable lift in U.S. tariff rates.

The distributional impacts of the bill are poor, and the bill will do little to alter the general K-shaped recovery and bifurcated economic trajectory between wealthier individuals and lower-income groups seen in the U.S. economy throughout the post-pandemic expansion. The bill does, however, have several provisions that will likely lift growth in the short-run, even if there is significant debate over whether the bill has deleterious impacts on long-run growth as increased government borrowing crowds out private domestic investment.

According to the Tax Policy Center, 53% of the tax bill’s benefits go to the top 10% of the U.S. population by income. While this is not helpful in lifting inclusive fortunes across the economy, it is a boost to growth considering modern economic reality – that the U.S. is increasingly reliant on its wealthiest residents to drive spending. Today, the bottom 80% of earners spend 25% more than they did four years earlier, barely outpacing price increases of 21% over that period. The top 10% spent 58% more over that same period and now accounts for half of all consumer spending according to Moody’s Analytics.

Tariffs, Inflation, and the Fed

While President Trump’s signature tax legislation is poised to expand deficits over the next decade meaningfully, the level of deficit expansion is blunted by the substantial jump in tariff revenues for the Federal Government, which recently crossed the $100 billion threshold in 2025, up 112% from the same period last year and is currently on pace for over $200 billion this year, assuming tariff rates remain at current levels.

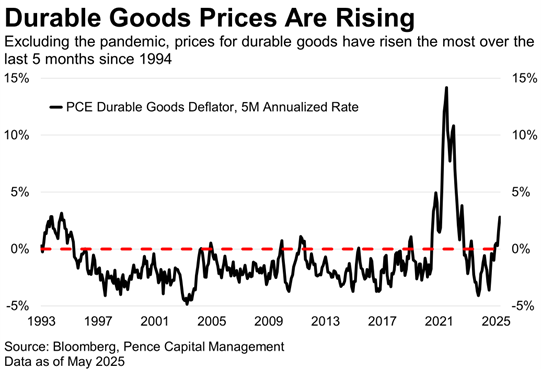

However, the lack of broad pressure on headline measures does not mean that inflation is not occurring. Durable goods prices have generally risen in 2025 after a long stretch of deflation. Additionally, June’s CPI showed a variety of tariff pass-throughs that were both brisk and broad. With the tariff pause ending and optimism around the economy generally regaining steam, there is a fair likelihood that inflation over the year’s second half could be running at a pace above the Federal Reserve’s comfort level. While this limits the number of rate reductions the Federal Reserve can deliver, we believe a rate hike is a very low probability outcome.

The ultimate extent to which tariffs are passed through to consumers remains a great mystery to markets, but there are hopeful signs regarding the impact of tariffs on prices and home and U.S. competitiveness abroad. First and foremost, retaliation against President Trump’s trade policies has been virtually non-existent – no trading partners except China and Canada have retaliated in any meaningful way. The central role of the United States in global trade, the lopsided nature of risk to growth, and a general fear of the hit to global supply linkages and inflation from any escalation have limited retaliation so far.

Conclusion

The 2025 edition of President Trump’s trade war also comes when global companies have gotten materially better at managing their businesses through volatility and crisis. The last 5 years have had a number of “once in a generation” events, including the 2020 COVID-induced lockdowns, the 2022 Russia-Ukraine war, and the subsequent 40-year high in U.S. inflation – which spurred a 22-fold increase in interest rates in response. Over this timeframe, S&P 500 companies missed earnings just once and operating margins never dropped below their 2019 average.

Today, companies are simply better at managing crises than they were in the 2018 version of Trump’s trade war, and there are anecdotal signs that companies are operating creatively through this or simply swallowing the trade levies in order to preserve market share.

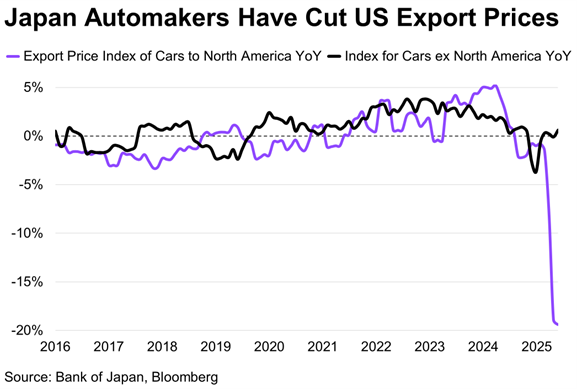

Data from the Bank of Japan shows that Japanese automakers have slashed car prices for US export by 19% from last year. Proxima, a supply chain consultancy owned by Bain & Company, has noted that many large global brands have limited the scale of price increases in the United States but raised prices in other international markets to compensate for the hit to U.S. margins, in what is a best-case scenario for both U.S. investors and U.S. consumers.

While it is a positive, companies are showing early signs of pricing power in terms of the likely trajectory for corporate profits, it has deleterious effects on the potential path of inflation and the Federal Reserve’s mandate around Stable Prices. However, it also implies that companies don’t have to defend margins by laying off workers – which would provide significantly greater economic challenges and the Federal Reserve’s other mandate of a labor force at Full Employment. Federal Reserve surveys of businesses paint an extremely mixed picture on pricing power and the timeline of pass-through, and the ultimate extent of tariff impacts on inflation is a question that only time will answer.

Forecasting the ultimate impact on the U.S. economy and U.S. markets will be difficult until we get a definitive answer on President Trump’s final tariff rate and more visibility on the pass-through. Significant uncertainty remains in the economic backdrop, however, over the last 5 years, the U.S. business sector and U.S. consumer have weathered a once-in-a-generation event every 18 months on average. We think this has instilled a quality of “Robust Variability” within the U.S. economy that we believe will prove resilient through this episode.